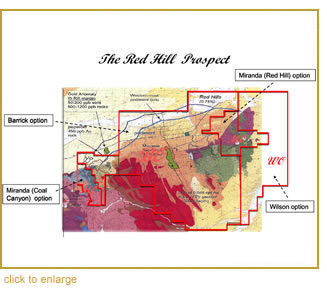

Three properties are consolidated to form the 45 square mile Red Hill Prospect in the Cortez Segment, the most prolific portion of the famed Battle Mountain-Eureka gold trend of Nevada. This  prospect is located directly between Barrick Gold’s 15.0+ million ounce Cortez Hills operation to the north and US Gold’s Tonkin Springs operation to the south. prospect is located directly between Barrick Gold’s 15.0+ million ounce Cortez Hills operation to the north and US Gold’s Tonkin Springs operation to the south.

The consolidated Red Hill Prospect is located in the south-east end of the Cortez segment in close geological proximity (just over the hill 13 miles) to the famous 21 million ounce Pipeline mine which Dr. Steininger, Director & COO, NuLegacy Gold, is credited with discovering in 1998.

It is optioned from Barrick Gold, Miranda Gold and Idaho Resources (Wilson property):

- NuLegacy earns 70% for expenditures of US$5.0 million over 5 years; Barrick then has a one-time election to earn back 40% for expenditures of $15.0 million and carry NuLegacy’s (then) 30% to production.

- NuLegacy earns 60% for US$4 million of expenditures over 5 years and a further 10% on completion of a bankable feasibility study.

- NuLegacy earns 100% on expenditures of US$4.0 million over 5 years.

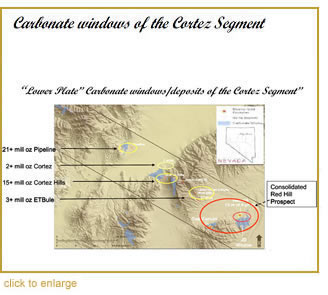

The Red Hill Prospect encompasses most of the 15+ square mile ‘JD’ carbonate window, the largest and least explored of the five major carbonate windows in the Cortez Segment. NuLegacy Gold believes that the JD Window has virtually the identical geology that hosts the existing four Carlin-type deposits in the Segment, which have their largest and best resources at depths between 500 and 1,200 feet. The Red Hill Prospect encompasses most of the 15+ square mile ‘JD’ carbonate window, the largest and least explored of the five major carbonate windows in the Cortez Segment. NuLegacy Gold believes that the JD Window has virtually the identical geology that hosts the existing four Carlin-type deposits in the Segment, which have their largest and best resources at depths between 500 and 1,200 feet.

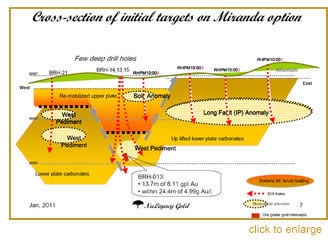

Much of the historical drilling on the Red Hill Prospect was completed in the 1980s and ‘90s when gold prices were in decline and operators in Nevada were seeking low cost near surface (less then 500 feet) heap-leachable oxide gold resources. They were operating without the benefit of recent advances in geology and drilling techniques. As a result the property has numerous shallow drill holes concentrated in a few areas with large portions having only scattered holes. NuLegacy’s re-interpretation of the geology of the property and previous drilling results indicates that parts of the Red Hill Prospect’s favorable horizons have been up-lifted much nearer to surface then recognized. Other parts had been re-mobilized creating additional near-surface favorable horizons with the potential to host economic material.

A respectable number of shallow drill holes (less than 450 feet in depth) have attractive gold intercepts at or near their bottom and there are several surface gold anomalies that have not yet been drilled. While there are few deeper holes drilled to date, several have significant intercepts, e.g. the 24.4m of 4.987g Au/t (80 ft of 0.146 oz Au/t) including 13.7m of 8.105g Au/t (45 ft of 0.237 oz Au/t) in lower-plate carbonate rocks on the Miranda portion of the Red Hill Prospect (illustrated below right) indicating the properties are capable of hosting potentially economic material.

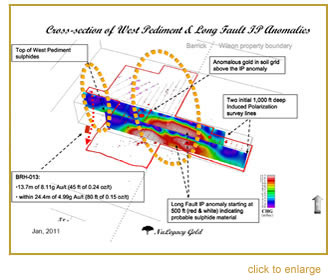

With the experience of having discovered the Pipeline gold deposit in the north-west end of the Cortez Segment, NuLegacy’s COO Roger Steininger was able to integrate and resolve the geology of the Miranda property and hypothesize the ‘Long Fault’ anomaly. This interpretation is supported by the two parallel Induced Polarization (IP) lines (illustrated below right) that were completed (to a depth of 1,000 feet) identifying the Long Fault IP Anomaly. With the experience of having discovered the Pipeline gold deposit in the north-west end of the Cortez Segment, NuLegacy’s COO Roger Steininger was able to integrate and resolve the geology of the Miranda property and hypothesize the ‘Long Fault’ anomaly. This interpretation is supported by the two parallel Induced Polarization (IP) lines (illustrated below right) that were completed (to a depth of 1,000 feet) identifying the Long Fault IP Anomaly.

The IP results indicate a very large, probably favorable, sulphide zone just below the level of the previous shallow drilling, which holes have anomalous gold intercepts likely representing leakage from the deeper sulphide zone. Superimposing (figure to right) the classic north by northwest orientation of the existing gold deposits in the Cortez Segment over the IP anomalies shows that the West Pediment and the Long-Fault IP Anomaly are likely ‘spilling over’ into the Barrick and Wilson portions. The IP results indicate a very large, probably favorable, sulphide zone just below the level of the previous shallow drilling, which holes have anomalous gold intercepts likely representing leakage from the deeper sulphide zone. Superimposing (figure to right) the classic north by northwest orientation of the existing gold deposits in the Cortez Segment over the IP anomalies shows that the West Pediment and the Long-Fault IP Anomaly are likely ‘spilling over’ into the Barrick and Wilson portions.

Thus there exists the possibility that the West Pediment anomaly joins up with the IP anomaly at depth, and that the high-grade intercept in hole RH-13 should be pursued in a north-by-northwest direction.

Exploration Programs: During the next two years NuLegacy intends to execute highly focused exploration programs on the Red Hill Prospect employing sophisticated techniques for targeting the drilling of carefully selected follow-up holes with immediate evaluation of the results. The proposed operating budget to process this prospect during the next two years is $4.0 million.

Upon successfully identifying a gold resource, follow-up delineation drilling budgets will be initiated to optimize the valuation. Once the Prospect’s value is established NuLegacy will seek to vend the resource for stock or cash, or merge with an appropriate and qualified gold producer to form a strategic partnership for its development.

|