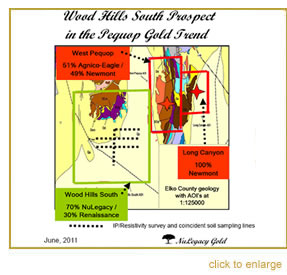

The 35 square mile Wood Hills South Prospect in the newly emerging Pequop trend is contiguous with the AuEx Ventures properties (Long Canyon and West Pequop) that Fronteer Gold recently acquired 49% of for approximately $250 million.

NuLegacy’s review of the Wood Hills South Prospect1, optioned from Renaissance Gold (successor to AuEx Ventures, Inc.) indicates it has similar geology and appears to be aligned on strike with West Pequop and Long Canyon discoveries. NuLegacy’s review of the Wood Hills South Prospect1, optioned from Renaissance Gold (successor to AuEx Ventures, Inc.) indicates it has similar geology and appears to be aligned on strike with West Pequop and Long Canyon discoveries.

The northern third of the Wood Hills South has similar surface exposures of gold and silver bearing jasperoids in Paleozoic carbonate rocks. These gold-bearing silicified zones and the associated trace element suite are characteristic of the margins of large areas of gold mineralization throughout Nevada. Previous geological mapping and limited geophysics indicate the southern two-thirds of the prospect has a pediment (bedrock) area with a relatively thin veneer of gravel covering the important potential gold host rocks and igneous intrusives that are associated with the existing gold deposits of the Pequop. For a full ‘Google’ aerial-view tour click the Pequop and watch the videos.

The Long Canyon & West Pequop’s gold resources have grown from a modest 0.4 million ounces at the end of 2008 when NuLegacy initially optioned the Wood Hills South to estimates in excess of 2.0 million ounces with new widespread gold mineralization intersected very near surface. Step-out drilling on the Long Canyon has ‘extended mineralization at least an additional 400 meters to the northeast of the existing resource model. Fronteer Gold2 reported that ongoing drilling has returned the best intercept to date at its wholly owned Long Canyon gold deposit in Nevada. Mineralization at Long Canyon continues to be 100% oxidized and remains open in all directions. New results, largely concentrated to the northeast of the current resource area, include:

- 12.30 grams per tonne gold (0.359 ounces per ton) over 50.4 metres, including 20.91 g/t gold (0.611 oz/ton) over 23.5 metres in LC577C;

The Long Canyon gold resource grew so dramatically during the past 18 months that Fronteer Gold recently paid approximately $250 million for the 49% of the two properties that it didn’t already own thus pricing 100% interest at approximately ½ billion dollars. With its similar geology NuLegacy’s management believes the Wood Hills South Prospect has significant potential.

Exploration Programs: During the next two years NuLegacy intends to execute highly focused exploration programs on the Wood Hills South Prospect employing sophisticated techniques for targeting the drilling of carefully selected follow-up holes with immediate evaluation of the results. The proposed operating budget to process these prospects during the next two years is $1.5 million.

Upon successfully identifying a gold resource, follow-up delineation drilling budgets will be initiated to optimize the valuation. Once the Prospect’s value is established NuLegacy will seek to vend the resource for stock or cash, or merge with an appropriate and qualified gold producer to form a strategic partnership for its development.

|